This detailed step-by-step guide will show you how to apply for a virtual card. If you wish to run Facebook or Google Ads or need a new card for your Google/Apple Pay accounts, you’re at the right place.

The entire process requires less than 10 minutes (at best) and 0 credit score verifications or documentation.

Let’s not waste time and start applying for your virtual card.

Table of Contents

How to apply for a virtual card?

This is how you apply for a virtual credit card:

Step 1: Go to the unlimited virtual cards provider LinkPay and click “Get Card”.

Step 2: Choose the card you need (Scroll to the next section to understand how these cards differ). Available options include:

- Omni Card

- eWallet Card

- Facebook Ads Card

- Google Ads Card

- Multi Ads Card

Step 3: You should now be on the customization page. Enter the following information:

- Name

- Payment system (You can choose from MasterCard and Visa)

- BIN

Step 4: You need to choose a plan. You may simply choose the free plan and move with it. (Scroll down, I’ve detailed the plans).

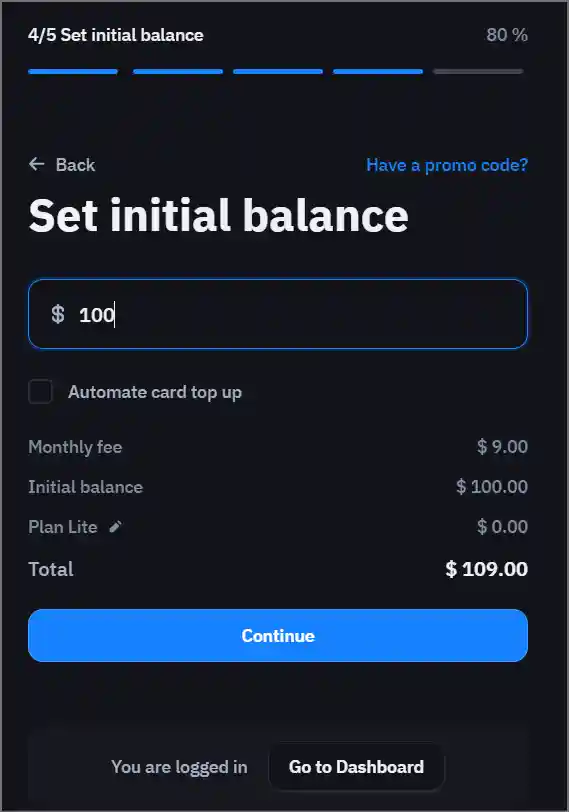

Step 5: Set an initial balance for your card. It can be as low as $1.

Step 6: Deposit funds to your account.

Done! As soon as your deposit goes through, you receive all your card details.

5 virtual card options

When applying for the card, you have to choose from one of these 5 options. Here’s how each of these virtual credit cards differs from the other:

- Omni Card: This is a 3Ds supported card that can be used for pretty much anything. From shopping on Amazon to buying servers, it doesn’t shy away from anything.

- eWallet card: You can connect this to your Google Pay as well as Apple Pay accounts and pay just like you do with a normal card.

- Facebook ads card: As the name suggests, these let you run Facebook ads risk-free.

- Google Ads card: Again, these are the best options if your priority is Google Ads. You will not be receiving those unwanted and overbearing safety alerts.

- Multi-ads card: This is more like an overall card. You can use it either for online ad campaigns or online purchases.

Do note that these are very specific cards. One may not work for everything.

Fees and Restrictions

Like any credit card, there are a few fees and limitations on your card. There are two primary payments associated with these virtual cards:

- Top-up fee: This is the fee you pay for depositing money from your LinkPay account to your card. This fee varies for each card and is dependent on the deposited amount.

- Monthly fee: It’s a fixed fee charged for the card you signed up for.

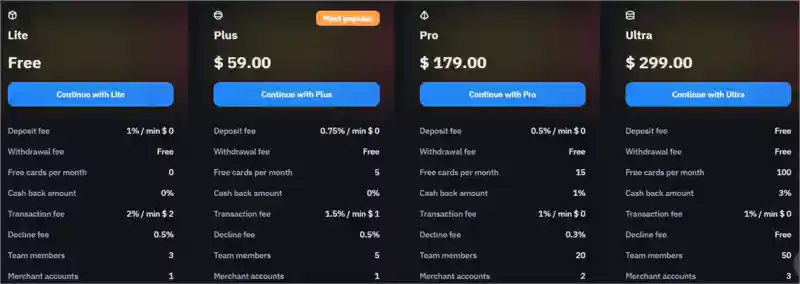

LinkPay also has subscription packages. These decide variables such as transaction fee, deposit fee, decline fee, transaction fee, etc. for your card.

This is optional and you may use a card without going for any paid subscription as well.

So, there are 4 plans:

- Free: 1% deposit fee, no withdrawal fee, no cashback, 2% transaction fee (or $2), 0.5% decline fee, 1 merchant account.

- Plus: $59.00- 0.75% deposit fee, no withdrawal fee, no cashback, 1.5% transaction fee (or $1), 0.5% decline fee, 1 merchant account, 5 free cards/month.

- Pro: $179.00, 0.5% deposit fee, no withdrawal fee, 1% cashback, 1% transaction fee (no minimum), 0.3% decline fee, 2 merchant accounts, 15 free cards/month.

- Ultra: $299.00, free deposits, no withdrawal fee, 3% cashback, 1% transaction fee (no minimum), 0.5% decline fee, 1 merchant account, 100 free cards/month.

How does the LinkPay virtual card work?

LinkPay virtual cards work exactly like physical credit cards. The only difference is you get your card details in a digital form and the cards may not work universally across all platforms.

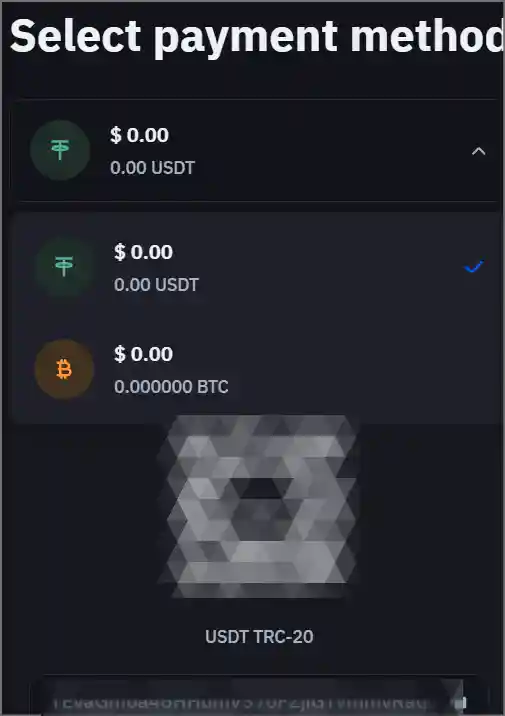

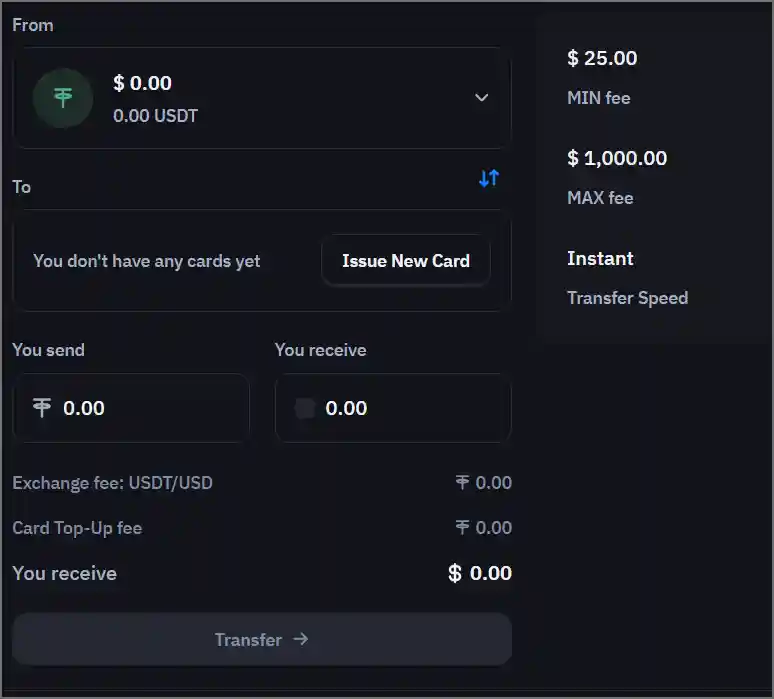

So, the basic working structure is simple. You need to “top up” your card to use funds. Cards can only be topped up from your LinkPay account. Hence, you need to deposit funds to your LinkPay accounts so you can top up your cards when needed.

Topping up cards is easy. There’s a “transfer” button on your dashboard.

You can transfer funds directly from your USDT or BTC wallets. It displays the fee required for the exchange right there.

This fund that’s now transferred to your card can be used from your card.

Frequently Asked Questions

If you were asking how to apply for a virtual card, it means you do not have a virtual card yet. It also means you may have a few more questions about virtual cards. Allow me to answer a few of them:

Q. Are Virtual Cards legal?

Virtual cards are 100% legal. They’re issued by Mastercard, Visa, and other world leaders. You are using your own money to fund your cards. There is absolutely no crime of any kind in using a virtual credit card.

Q. How are virtual cards different from physical or normal credit cards?

Virtual credit cards do not have a credit line. You must fund them in advance from one or the other account. Normal credit cards have a credit line. This means you can spend funds within your credit limit even if you do not have anything in the bank account. Virtual cards can only spend what you’ve deposited.

Q. Can anyone get a virtual card?

Yes, Anyone can get a virtual card. This is another difference between physical and virtual credit cards. Normal credit cards have many requirements and legal forms to fill. Virtual Credit cards are like signing up on social media and anyone can own one.

Q. Can I change my virtual credit card number?

You can’t exactly change it manually. However, LinkPay issues 5/10/15 free new cards each month depending on your subscription plan.

Conclusion- How to apply for a virtual credit card?

I’m sure you’ve learned how to apply for a virtual card by now. The steps are pretty simple and can be followed even without a guide or a tutorial.

Simply decide which card you want and deposit enough funds in your account. By enough, I mean do not go overboard. Keep slightly more than you absolutely need but do not use it as a savings account.

That was all for this guide folks, go apply those virtual cards and get your ads running (or shop, your wish).

You should also read an article on the Pros and Cons of Virtual Credit Cards.