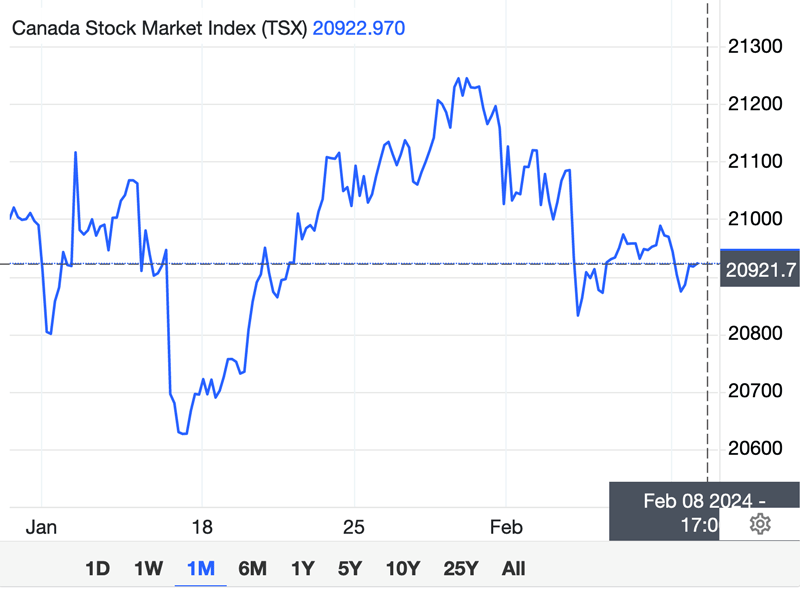

Source: TradingEconomics.com

Traders have a variety of financial instruments available to generate returns on market volatility. The traditional approach to stocks, commodities, indices, forex, ETFs etc. requires price appreciation over time. In and of itself, price appreciation – the linear model – is insufficient to measure profitability over time. Given the dramatic and unprecedented inflationary pressures, real price appreciation must warrant the trade or investment.

Canada, for example, boasts an inflation rate of 3.40%, up from 3.12% in January 2024. While high, it pales compared to the 6.32% inflation in 2023. Regardless, inflation remains one of the most detrimental elements to profitability.

Only a few investment arenas benefit from rapidly rising inflation, notably property. This is on the proviso that investors get into the markets when interest rates are low (interest rates and inflation are flip sides of the same coin), and investors can lock in low-interest rate mortgages.

Real estate remains one of the most lucrative, albeit difficult, investment options available to Canadians today. From 2020 – 2022, monetary accommodation by central banks worldwide flooded the economy with cheap money. With ultralow interest rates to facilitate economic growth, in the face of supply chain bottlenecks, too much money started chasing too few goods and services.

This resulted in rapidly rising prices across the board. With limited housing, massive demand pushed up prices. Today, Canadian housing market valuations are generally 50% higher than pre-Covid. The high interest rate on borrowed funds exacerbates this, making mortgages astronomically expensive.

CFDs as Contrarian Options

Beyond property, other contrarian trading and investment options are available nowadays. These include CFDs. A CFD is a contract for difference – a derivatives trading instrument. What makes CFDs different from traditional trades and investments is the following:

- A CFD is a contract tracking the price movement of the underlying financial instrument. Traders and investors are not required to purchase stocks, commodities, forex, indices, Treasuries, bonds, or ETFs. It’s simply a contract that finishes in or out of the money at expiry.

- A CFD uses margin and leverage. These can maximize rewards if traders successfully forecast price movements. Conversely, CFDs can result in outsized losses when traders forecast incorrectly. Fortunately, margin requirements with many top-tier brokers today will allow traders to continue meeting the margin requirement, or else the trade will close out.

- A CFD facilitates long and short positions. This is the kicker as far as traditional investments are concerned. Recall that a standard stock investment requires the price to appreciate over time. With CFDs, you can hedge against depreciating stock prices by adopting a short position on a CFD stock. This considers many different types of CFD trading strategies – tailored to your particular preferences and the situation.

- Another important benefit of CFD trading is the taxation on them. In the UK, for example, no stamp duty is attached to CFDs – they are not assets. However, capital gains taxes may be imposed on profits depending on where you live. So, checking with the relevant authorities is important to ensure your compliance with requirements.

Cash In Banks

For the longest time, it simply didn’t pay to invest your money in CDs (certificates of deposit) with banks, building societies, or investment firms. The return on capital was negligible. Today, it’s possible to invest cash with 4.0% – 5.0% returns per annum, depending on the financial institution. While certainly not a game-changing amount, it presents as another safe-haven option.

Environmental Sustainability Investments

These types of investments align with the sustainable energy initiatives currently underway with governments worldwide. These are long-term investments, a.k.a. strategic investments. High costs and low adoption rates make it difficult to attract returns on things like electric vehicle technology, alternative fuel and energy sources, etc.

However, there is an increasing demand for clean energy, and policy changes and consumer preferences steer the world in that direction. Stock in companies like Tesla, General Motors, Ford, and others presents another avenue for generating long-term returns. Overall, it’s important to continually update your portfolio to reflect societal changes, preferences, and projections.

Navigating the intricate web of the financial markets demands a diversified investment strategy, blending traditional and contrarian elements. This multifaceted approach dilutes risk and seizes upon disparate market opportunities.

In our ever-evolving financial ecosystem, agility, informed decision-making, and a keen eye on global economic indicators such as inflation and interest rates are indispensable. With big picture perspective it’s possible to balance risk management and profitability.