The best personal finance books for young adults include The Richest Man in Babylon, Rich Dad Poor Dad, The Total Money Makeover, and more.

These best books on personal finance provide clear strategies for budgeting, investing, and saving money while helping you understand wealth and make informed financial decisions.

So, if you are ready to take control of your financial future, these books for managing money are the perfect place to start.

Table of Contents

- Best Personal Finance Books

- 1. The Richest Man in Babylon

- 2. Rich Dad Poor Dad

- 3. The Total Money Makeover

- 4. You Are a Badass at Making Money

- 5. Financial Freedom

- 6. The Simple Path to Wealth

- 7. Broke Millennial

- 8. I Will Teach You to Be Rich

- 9. The Psychology of Money

- 10. Smart Women Finish Rich

- 11. The Millionaire Next Door

- 12. The Intelligent Investor

- 13. The Barefoot Investor

- 14. Dare to Dream and Work to Win

- 15. Principles: Life and Work

- 16. The Wealthy Gardener

- 17. The Little Book of Common Sense Investing

- 18. Money: Master the Game

- 19. The Millionaire Mind

- 20. The Simple Dollar

- Conclusion

Key Takeaways

- The Richest Man in Babylon: Learn timeless money management lessons through ancient parables on saving, budgeting, and investing.

- Rich Dad Poor Dad: Understand the difference between assets and liabilities, and adopt a mindset that focuses on building money.

- The Total Money Makeover: Step-by-step guide to help you manage debt and achieve financial freedom.

- You Are a Badass at Making Money: Build confidence in managing money, with relatable advice and personal growth exercises to achieve financial success.

- Financial Freedom: Understand the importance of saving, investing, and creating multiple income streams to achieve financial independence early.

- The Simple Path to Wealth: Embrace simple, low-cost investing strategies focused on wealth-building over the long term

- Broke Millennial: Makes personal finance relatable with actionable advice for millennials.

- I Will Teach You to Be Rich: Discover practical strategies for managing money, avoiding debt, and investing for future wealth with a focus on automating finances.

- The Psychology of Money: Understand the psychological aspects of money management, emphasizing long-term thinking and the emotional factors that influence financial decisions.

- Smart Women Finish Rich: A comprehensive guide to financial planning specifically designed for women.

- The Millionaire Next Door: Learn the habits and traits of financially successful individuals who live below their means and prioritize wealth-building.

- The Intelligent Investor: A deep dive into value investing and building long-term wealth.

- The Barefoot Investor: A practical guide to managing money with a step-by-step approach.

- Dare to Dream and Work to Win: Use network marketing, personal development, and goal-setting to achieve financial independence and success.

- Principles: Life and Work: Combines life and work philosophies essential for disciplined decision-making.

- The Wealthy Gardener: Emphasizes purpose-driven wealth-building and financial resilience.

- The Little Book of Common Sense Investing: Understand the power of low-cost index funds and long-term investing to build wealth over time.

- Money: Master the Game: Learn from financial experts on how to create a solid investment plan that leads to financial freedom.

- The Millionaire Mind: Explore the mindset and habits that distinguish successful individuals, emphasizing the importance of attitude in wealth accumulation.

- The Simple Dollar: Shares practical advice for financial literacy and finding happiness in simplicity.

Best Personal Finance Books

Here are some wealth books that will help you understand money and build smart financial habits:

1. The Richest Man in Babylon

By: George S. Clason

Best For: Beginners seeking timeless financial advice

The Richest Man in Babylon delivers timeless personal finance lessons through parables set in ancient Babylon. It offers practical advice on living below your means, saving at least 10% of your income, and seeking guidance from financially successful people.

Key principles of this book include budgeting, investing, and disciplined money management. And the emphasis on financial discipline, patience, and long-term wealth-building makes it a great starting point for beginners to understand key habits for financial success.

2. Rich Dad Poor Dad

By: Robert T. Kiyosaki

Best For: Understanding assets vs liabilities

Rich Dad Poor Dad compares the financial philosophies of Kiyosaki’s two “dads”- his biological father (the “Poor Dad”) and his best friend’s father (the “Rich Dad”), emphasizing the difference between assets and liabilities. It highlights the importance of surrounding yourself with people smarter than you.

Furthermore, the book encourages shifting from “I can’t afford it” to “How can I afford it?” and teaches the value of working to learn, not just to earn, by building skills that lead to financial independence.

3. The Total Money Makeover

By: Dave Ramsey

Best For: Getting out of debt and achieving financial freedom

The Total Money Makeover offers a stepwise guide to get out of debt and achieve financial freedom. It provides practical advice on creating a budget, controlling your expenses, and building an emergency fund.

The focus is on living below your means and avoiding lifestyle inflation, with a motivation to adopt a disciplined, no-excuses approach to money management.

The book advises readers to put their wealth in perspective by giving a part of their income to charity. Additionally, the book introduces the Baby Steps approach to paying off debts using the debt using the snowball method.

4. You Are a Badass at Making Money

By: Jen Sincero

Best For: Overcoming self-doubting and building wealth

You Are a Badass at Making Money is a motivational book to overcome self-doubt and develop a positive relationship with money. It provides insights into identifying and breaking through limiting beliefs about wealth and success. In this book, you will also find practical tips on manifesting abundance and the money mantra (I love money because I love myself) to get rich.

Moreover, the book encourages readers to take bold actions and step outside their comfort zone to earn more. The book also features relatable stories from the author’s journey from financial struggle to earning six figures.

This blend of personal growth and money-making tips empowers readers to achieve their financial dreams. Through practical exercises, affirmations, and actionable advice, the book helps to build confidence in earning and managing money.

5. Financial Freedom

By: Grant Sabatier

Best For: Achieving financial freedom

Financial Freedom is the best personal finance book that provides a comprehensive guide to achieving financial independence as early as possible. The book has explained the practical plan to make money in seven steps and they are:

- Figure out your number

- Calculate where you are today

- Radically shift how you think about money

- Stop budgeting

- Hack your nine-to-five

- Start a profitable side hustle and diversify your income streams

Additionally, Grant Sabatier emphasizes the importance of tracking your net worth and taking a proactive approach to increasing your savings rate. He also discusses how to boost income through side hustles and optimizing your career.

6. The Simple Path to Wealth

By: JL Collins

Best For: Building wealth simply

The Simple Path to Wealth simplifies the principles of investing and wealth building. It provides clear and simple advice on achieving financial independence through low-cost index fund investing.

The book covers topics such as debt elimination, building wealth over time, and how to avoid common investing mistakes. Also, it highly emphasizes the power of financial freedom and the flexibility it provides.

In short, The Simple Path to Wealth is a beginner-friendly guide to understanding the basics of money management and investing.

7. Broke Millennial

By: Erin Lowry

Best For: Millennial financial advice

Broke Millennial is a practical guide for young adults looking to handle their money management. It provides simple advice on complex financial topics like budgeting, debt, saving, and investing, tailored specifically for millennials.

The book also covers the simple steps for starting to save and invest, even with a limited income. In this book, Erin Lowry discusses everything from setting up a budget and handling student loans to beginning investing and building credit.

What I really like about this book is its fun and relatable explanation like comparing money to Tinder dates and marriage or using terms like YOLOFOMO to describe the struggle between enjoying life and saving for the future, and many more.

8. I Will Teach You to Be Rich

By: Ramit Sethi

Best For: Practical money management and wealth-building

I Will Teach You to Be Rich is a step-by-step guide to building wealth with practical advice on budgeting, saving, and investing. It offers tips on automating finances to reduce stress and ensure consistent savings. He also dives into strategies for investing in low-cost index funds, negotiating salaries, and planning for long-term financial success.

What sets it apart from other books on saving money is its no-judgment, realistic approach that empowers readers to take control of their financial future. Sethi encourages readers to prioritize spending on things they love while being efficient with the rest of their money.

9. The Psychology of Money

By: Morgan Housel

Best For: Understanding money behavior

In The Psychology of Money, Morgan Housel explores how emotions and behavior impact financial decisions. The book explains how money is not something that can be decided on a spreadsheet but it depends on personal behavior, emotions, and the decisions we make over time.

In addition, Housel discusses the value of being financially humble and understanding that luck plays a significant role in financial success.

10. Smart Women Finish Rich

By: David Bach

Best For: Financial independence for women

Smart Women Finish Rich is a personal finance book tailored to help women take control of their financial futures. In this book, David Bach mentions the actual status of women who earn less than men but live longer, making it essential for them to be proactive about their financial planning.

The book highlights the importance of starting early with small but consistent financial decisions. It provides practical strategies for saving money, managing debt, and making better financial decisions. Back also discusses the empowering strategies to close the gender wealth gap and achieve financial confidence.

11. The Millionaire Next Door

By: Thomas J. Stanley & William D. Danko

Best For: Wealth-building habits

The Millionaire Next Door is one of the money books that provides insights into the habits and lifestyles of millionaires in America, revealing that many wealthy individuals live below their means. The book emphasizes that most millionaires are self-made, having accumulated wealth through disciplined saving, investing, and living below their means

According to Thomas J. Stanley & William D. Danko, it’s easier to accumulate wealth if you don’t live in a high-status neighborhood. This will help you feel financially secure while limiting the expense of impulsive purchases.

The book also offers advice on how to pass down wealth through responsible financial planning, making it a valuable resource for anyone seeking to build wealth through smart, consistent decisions.

12. The Intelligent Investor

By: Benjamin Graham

Best For: Learning value investing

The Intelligent Investor is a timeless finance book in the world of investing, focusing on buying undervalued stocks relative to their intrinsic worth. The book focuses on the concept of margin of safety which involves protecting yourself from significant losses by investing cautiously.

In this book, he introduces the idea of investing with a long-term perspective and be cautious against reacting to short-term market fluctuations. In a nutshell, the book teaches investors to prioritize consistency, focus on diversification, and rational decision-making, which leads to steady financial growth over time.

13. The Barefoot Investor

By: Scott Pape

Best For: Simple financial strategies (Australia-focused)

The Barefoot Investor by Scott Pape provides a simple yet effective way to manage money. In this book, he introduces the Barefoot steps to help you focus on one thing at a time. It includes Scheduling a monthly barefoot date night to regularly review and plan finances, setting up the bucket system for budgeting, and using the Domino Your Debts strategy to get rid of your debt.

The steps also cover significant milestones like buying a home, increasing your retirement savings to 15%, and boosting your MOJO to three months.

Scott Pape further emphasizes the importance of calculating your retirement number and planning to leave a legacy for the coming generations.

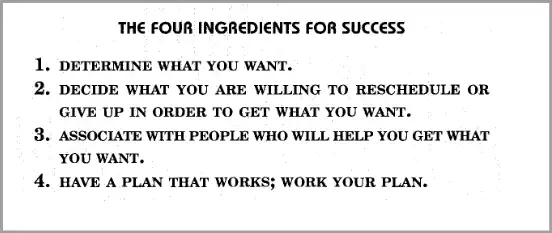

14. Dare to Dream and Work to Win

By: Dr. Tom Barrett

Best For: Entrepreneurs, network marketers, and individuals seeking motivation and practical guidance to pursue ambitious goals while building resilience and analytical skills.

Dare to Dream and Work to Win serves as a practical tool for young adults seeking financial success. This book is centered around the principles of network marketing, personal development, resilience, and financial independence.

The book further emphasizes the importance of dreaming big and setting ambitious goals as the foundation for building a fulfilling and financially secure life. In his book, he also mentioned four key ingredients for success and fulfilling your dreams.

15. Principles: Life and Work

By: Ray Dalio

Best For: Life and work principles from a successful investor

Principles: Life and Work is a thought-provoking book that combines personal and professional philosophies to help you navigate your financial and personal journeys. While it is not solely a personal finance book, its principles for disciplined decision-making and effective problem-solving are crucial for financial success.

Moving further, the book is divided into three parts in which part one is completely dedicated to the author’s journey. The second part is the core of the book. It presents life principles such as embracing reality, being radically transparent, and maintaining discipline which is essential for success. And the third part explains how these work principles apply to his life.

These life principles encourage readers to think critically, prioritize their goals, and take actionable steps toward achieving them, making it a compelling resource for those seeking to master both life and work.

16. The Wealthy Gardener

By: John Soforic

Best For: Financial independence and balance

The Wealthy Gardener is a personal finance book that uses a fictional narrative to share practical money wisdom. The book is presented as a conversation between a father and his son where the father tells the life lesson about money management and investing.

One of the best things he told his son in this book is that he will go through different seasons in life, but he should be enjoying all of them equally.

The book also highlights the importance of not rushing to make more money but adopting a patient, disciplined approach to wealth-building. Instead of focusing solely on earning more, the emphasis is on smart financial habits, consistent investing, and prioritizing long-term goals.

In brief, The Wealthy Gardener book teaches you to be patient, develop a wealth mindset, and most importantly live a fulfilled life. After all, the purpose is not just to collect money, but to enjoy a life of freedom, security, and purpose.

17. The Little Book of Common Sense Investing

By: John C. Bogle

Best For: Simple, low-cost investing strategy

The Little Book of Common Sense Investing is a straightforward guide to building wealth through simple, long-term investment strategies. The core lesson of the book is that most investors are better off investing in low-cost, diversified index funds rather than trying to pick individual stocks or actively managed funds.

Bogle emphasizes that the key to financial success lies in minimizing investment costs and adopting a long-term approach. He highlighted that the stock market’s growth over time is inevitable, and rather than trying to outsmart it, investors should passively track it using broad market index funds.

The book also teaches the importance of regular contributions, avoiding market speculation, and sticking to a simple strategy that minimizes risk and maximizes returns over time.

18. Money: Master the Game

By: Tony Robbins

Best For: Mastering wealth and financial freedom

Money: Master the Game is the result of Tony Robbin’s extensive interviews with over 50 of the world’s top investors, including billionaires like Warren Buffett and Ray Dalio. These interviews provide insights into how the wealthy manage their money and build wealth.

The core lessons of the book revolves around the seven key pricinples like importance of asset allocation, power of high fees, etc. that can help you master wealth and create long-term financial security.

Moreover, the book teaches us to adopt a mindset about creating lasting wealth that can provide financial freedom and peace of mind.

19. The Millionaire Mind

By: Thomas J. Stanley

Best For: Understanding the mindset of the wealthy

The Millionaire Mind is a book that differentiates millionaires from the average person in terms of their behaviors, mindsets, and habits. It is based on his earlier work, The Millionaire Next Door, and focuses on what contributes to their success from financial habits to values.

He also highlights the importance of following a balanced approach in life because even millionaires are not “Only work, no play” type of people. The book reveals that most millionaires build wealth through discipline, hard work, and thoughtful decisions, and not inheritedly. So, anyone can adopt these habits to achieve financial independence.

20. The Simple Dollar

By: Trent A. Hamm

Best For: Simple budgeting and saving advice

The Simple Dollar is one of the best personal finance books for everyone who wants to get rid of their debts, regain control of their finances, and build a stable financial future. Besides this, the author wonderfully explained how real wealth lies in simple things that bring you happiness.

He also explained five simple steps to find happiness in today’s busy life or in simpler words, to embrace authenticity and be yourself everywhere in life.

Furthermore, Hamm shares his personal journey of overcoming significant debt, detailing methods like debt snowballing and focusing on high-interest liabilities first.

Conclusion

The books covered in this list provide invaluable insights and strategies for money management and financial independence.

From timeless lessons on budgeting and investing in The Richest Man in Babylon, to the mindset shifts promoted in Rich Dad Poor Dad and The Psychology of Money, each book offers unique approaches to mastering your finances.

By reading these best personal finance books, you can make informed decisions, develop smart money habits, and take your wealth to the next level.

Related Readings