Here are the best payroll software for small business. You’re bound to find a payroll solution here that’ll take all the hassle off your hands.

Most of these tools will pay your employees, file & pay your taxes, and even take care of compliances. Some even let you offer health & dental benefits and track employee work hours.

Tight on the budget? Fret not, I understand small businesses don’t have a million bucks. Keeping that in mind, I’ve also included a 100% free payroll software just or you!

Obviously, the “best” option for you would depend on your specific needs, wouldn’t it? So, lets see which of these would be your payroll manager eh?

Table of Contents

The 8 Best Payroll Software for Small Business 2024

Here are all the tools I’ll be discussing throughout this list:

- Gusto: Most feature-rich & rationally-priced. Recommended*

- Payroll4free: For those who need 100% free payroll software

- ADP: Best alternative to Gusto

- OnPay

- Patriot*

- Paychex

- Trinet

- Square Payroll

*These file & pay your taxes for free without requiring additional payments.

1. Gusto

Website: https://gusto.com/

Primary features:

- Gusto Debit card

- Unlimited payrolls

- Calculate, file and pay taxes for FREE

- Multiple pay rates

- Manage contractors

- All forms and compliances auto-managed

- Hourly and fixed salaries

- Lifetime paystub management

- Insurances/tax-benefits covered

- Complete HR management solutions

Gusto isn’t just the best payroll software for small business 2024. It actually is one of the most advanced HR management software I’ve seen.

For starters, there’s a “Gusto debit card”. You heard that right! You can offer this optional debit card to your employees. They can get paid and use their funds anywhere on the planet using the card.

Gusto offers unlimited payrolls every month. No extra charges for bonuses, off-cycle payrolls or anything else. Of course, it can be automated so employees get paid on automation without requiring manual intervention.

You can set your payments to be weekly, bi-weekly, every 15-days or monthly.

It automatically takes care of “all” your taxes! And I don’t just mean “remind you”, or “shows you a form”, I mean really “takes care of it”.

It calculates, files and then pays your state & federal taxes on automation! This is an extremely rare feature, most other tools charge extra for this.

New hirings are automatically reported and even W-2s and 1099s are sent to your employees automatically.

All payments are directly debited from your company account, and sent to their respective destinations. This includes government agencies, employee bank accounts and even charities if you say so.

As for payrolls, you can pay employees based on hourly or fixed contracts. Yes, Gusto integrates with nearly all the major project management and time-tracking apps out there.

You can also add paid holidays. Employees can request time off, which is then auto-synced with their payment. Paystubs still exist, just digitally. Employees can access their stubs in the e-mail as well as in their Gusto accounts.

Medical insurances, 401(k)s and other tax-benefits are auto synced with the payroll.

The one feature I love about Gusto? It lets employees retain their accounts and hence paystubs and work-history lifetime, even after job changes.

Obviously, Gusto can be managed from a mobile app and a computer isn’t mandatory.

Gusto plans start at $40.00/month + $6.00/month/person.

2. Payroll4Free

Website: https://www.payroll4free.com/

Primary features:

- 100% free, fully-featured.

- Tax forms/filing/pre-filled forms

- Automated tax payments (paid)

- Direct bank deposits (paid)

- Contractor management

- Employee portal

- Time-tracking (vacations/ sick leaves etc.)

- Third-party integrations

On top of being the best small business payroll software, it’s also forever free! You get all the features for free as long as you’ve a <25 member team.

You can manage employees, as well as contactors. 1099 forms can be created as well as filed using Payroll4free.

While Payroll4free too can file & pay taxes, it charges extra for doing so. You do get access to pre-filled tax forms for free though.

Employees get their own portal too. They can manage their pay stubs, vacations and everything else right from the portal.

Its in-built time-tracking is pretty impressive. You can assign/track vacation times, sick leaves, paid leaves and everything else. All this is synced and calculated automatically when generating the payroll.

Of course integration with third-party tools is possible. This lets you not just export but also import data in case your employees use a third-party tool.

As for payments, you can choose to pay using physical cheques, or the much faster direct bank deposits. Direct bank deposits aren’t included in the free plan.

Even if you opt for the two optional paid add-ons (taxes/direct payments), you pay only $30.00/month.

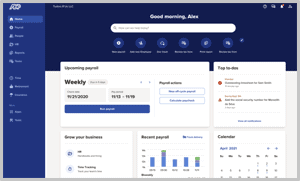

3. ADP

Website: https://www.adp.com/

Primary features:

- Complete tax management (charged extra)

- Health, insurance and other benefit management

- Contractor payments

- Wisely® Direct (debit card for payments)

- Error-prevention feature

- Time tracking features

- Employee dashboard

- Base price: $59.00

Some argue ADP to be the best payroll system for small business, and the claim isn’t completely baseless.

It too is a complete HR management software and the payroll feature is just one tiny superpower from its arsenal.

ADP too calculates, files and pays your taxes if you let it. It’s not just for employees, but also for contractors. Meaning, 1099s are taken care of as well. Do note that this requires additional payment and isn’t included for free.

You can run payrolls anytime, from any device. Additionally, these can also be automated.

It also has time-tracking features for hourly billings. Even insurance claims and employee benefits can be managed. Retirement plans are taken care of as well including 401(k)s, SEP IRA and others. These benefits are charged extra though.

You can make payments using direct deposits or ADPCheck. There’s also Wisely® Direct, this unique debit card offered by ADP can also be used by your employees to receive their payments.

There’s also this unique error prevention feature. It can detect and flag potential errors even before they happen!

As far as employee management goes, you can create schedules and even be notified of overtime status for employees.

Time tracking is available as well. You can track the hours worked, create & publish schedules and even approve/decline break/vacation requests.

Employees get their own portal, but, they can also use a dedicated app built just for them.

As far as “suitability” goes, it 100% is made for small business. In fact, there’s an entire pricing package labelled “small business”!

As for the pricing, it starts at about $59.00/month. However, it’s very feature-specific. So, depending on the features you opt for the pricing may vary.

4. OnPay

Website: https://onpay.com/

Primary features:

- Unlimited payrolls

- Health, insurance, dental benefits

- Customizable reports

- Pay taxes (charged extra)

- Industry-based payrolls

- Direct deposits + Paycard

- Mulitple payment rates possible

- Strating price: $40.00 + $6.00/user

OnPay has multiple awards to its name, but that’s not why it’s on this list. So, it too offers unlimited payrolls on all its accounts. You only pay for those employees who you pay using OnPay. You will not pay if you do not generate an employee’s payroll using OnPay.

It also pays all your taxes including the 941 and 940. OnPay does offer one of the most customizable reports you’ll ever see. There are no geographic restrictions, your employees can be from any of the 50 states.

Health, insurance, dental and all other benefits are taken care of as well. Time tracking too is possible via third-party apps, it’s free.

OnPay offers customized payrolls depending on the “industry”. E.g. for restaurants it manages tips and form 8486, Nonprofits can automatically benefit from tax exemption and so on.

Employees get their own portals. Managing pay stubs, tax forms and everything else becomes easier. They can access this information even after leaving your company.

COVID-19 and other compliances too are taken care of. You can assign specific access permissions to specific individuals. Keeps the chain of command intact.

Different payment rates can be set for different individuals, even within the same payroll.

Direct deposits and cheques can be used for payments. However, the best part? Your employees don’t even need to have a bank account! You can also pay using payroll cards from OnPay.

The pricing is pretty transparent. They charge a $40.00/month fee + $6.00 for each worker you pay.

5. Patriot

Website: https://www.patriotsoftware.com/payroll/

Primary features:

- Calculate, file and pay taxes

- Multiple pay-cycles and amounts

- Time-tracking (additional add-on)

- Repeating money types

- Direct deposits and cheques

- Employee portal

- Contractor management

- Starting price: $17.00/month + $4.00/employee

Patriot offers probably one of the best user-interfaces on this entire list of best payroll software for small business.

There are no limits on the number of payrolls you can run each month, it’s unlimited. You can even choose to pay different amounts, to different groups of employees. Not just that, you can choose to pay some groups weekly, biweekly, once every 15-days or just monthly.

It also files and deposits your taxes. This is free on the “full service” plan. The plan costs less than what most other tools charge for their normal packages.

Repeating money types can be created for payments which are incurred every month. Time-tracking is obviously possible.

It’s location-free. Your employees can work from just about anywhere and it auto-adjusts the taxes based on their location. It’s COVID-ready as well and “work from home” is an option as well.

It allows direct deposits (2 & 4 days) as well as cheques. Employees do get their own portals which gives them their pay stubs, W-2 forms, time off management etc.

You can use it from a mobile phone, without downloading an app. On top of employees, you can also manage contractors on the same payroll.

As for pricing, there are two packages. “Basic Payroll” is the cheaper plan. It costs $17.00/month +$4/employee/month. It includes all the features except paying taxes.

The “Full service” plan costs $37.00/month + $4.00/employee. It includes everything (even the taxes) and still costs less than most other tools on this list ,doesn’t it?

6. PayChex

Website: https://www.paychex.com/

- Tax payments (extra fee)

- Health, insurance and other benefits management

- Manage contractors

- Time tracking

- Error-prevention features

- Easy migration from previous payroll solution

- Base price: $39.00

PayChex provides some of the best payroll programs for small business. It lets you customize your package depending on your team-size and needs.

It too lets you manage both employees and contractors. Wages can be directly deposited to your employees’ bank accounts. Check printing service too is available. For even more convenience, there’s also a debit card called the Paycard.

It even has advanced payment modes such as “pay on demand” (paid in advance) and “real time payments”.

PayChex does let you pay taxes directly. However, this costs extra. Similarly, W-2 and 1099 forms too can be auto-filed, but again, are charged extra.

Automated time tracking is one of the available features. You can do that on its web version, on the mobile app or even smartwatches! It has breaks, meals and other such features.

401(k)s, retirement plans, health insurances and other benefits are also integrated and managed for yourself or your employees.

Even if you already use a Payroll service, PayChex makes migration extremely easy and smooth.

Its checks & balance feature is impressive. Both you and your employees get to verify and report mistakes before you run a payroll. Helps avoid mistakes (and lawsuits).

You can also integrate third-party apps.

Unfortunately, there are no free plans. The base price starts at $39.00

7. Trinet

Website: https://www.trinet.com/

Primary features:

- Tax management and payment

- Employee portal

- Health, Insurance and other benefit management

- Expense tracker

- Time-tracker

- Visual schedules

- Pricing is not transparent.

Trinet again is more than just one of these payroll programs for small business. It’s a complete HR solution. As far as features go, it ticks all the common boxes.

It also files and pays all your taxes, both state and federal. Your employees can also import W-2 forms. It also manages unemployment taxes.

Time tracking is available. You can track an employees total hours, approve time-off requests, or create visual schedules for them.

It also has an in-built expense tracker! The data is auto-fetched from bank accounts and cards when allowed to. Health benefits, retirement plans, insurance policies and many other such benefits can be administered and managed using Trinet.

Employees do get their own portal. As expected, they can use this to download pay stubs, tax forms, request time off and so on. This gives them lifetime access to their data even if they leave you.

The one aspect that hurts? Its pricing. You need to contact them using the on-site form or call for a quote. This is just a major turnoff for me personally. Now, the app still is equally impressive, however, this just is an additional hurdle I’d rather avoid.

8. Square Payroll

Website: https://squareup.com/

Primary features:

- Taxes files and paid

- Employee portal

- Time-tracking

- Direct deposits, check and Cash app payments

- Unlimited payrolls

- Live-chat

- Pay directly using Square funds

Square Payroll offers is an all-around solution when it comes to managing payrolls. Starting with the taxes, it files and pays your state & federal taxes. Quarterly & yearly filings, IRS and Social security forms are all taken care of.

You can track the amount of time your employees work and pay accordingly. You can integrate tips and commissions into the payroll as well. It also syncs the Workers’ comp insurance with the payroll.

It allows payments via direct deposits, check as well as the very popular Cash App. There’s this unique feature which lets you use Square as a wallet. You can store funds on the platform and pay faster using these funds.

There are no limits on the number of payrolls either. It has this native mobile app which lets you run payrolls using just two thumbs!

There’s also a live-chat for help in case something goes wrong. Employees do get a self service portal reducing your role in setting them up or future information requests.

Third-party integrations are obviously possible. The pricing is pretty transparent. If you choose to pay both employees and contractors, there’s a $35.00 monthly fee + $5.00/employee.

If you choose to only pay contractors and not employees, there’s no monthly fee and it costs only $5.00/contractor. This is the cheapest and best payroll software for small business for you if you’re only paying contractors.

Final verdict- What is the best payroll software for small business?

In terms of features and pricing, Gusto is without doubt the best payroll software for small business in the industry.

If not Gusto, you should try going with ADP or OnPay. They more or less offer the same features and value.

It basically depends on what you’re looking for, how much time you’re willing to invest, what’s your budget, employee-size and so on.

If you’re willing to pay your taxes manually, you’ll save money but this will cost you time.

Similarly, letting the tools pay taxes costs money but saves time (not if you go with Gusto or other options which offer free tax payments). However, it also keeps things error-free and accountability off your hands.

I’d recommend going with a payroll system for small business that takes care of your taxes and other compliances. This saves not just time, but a lot of other hassles you better avoid.

That’ll be all for now. Give these a try, see which is the best payroll software for small business for “your” needs.